In the fast-evolving landscape of digital payments, Unified Payment Interface (UPI) apps have emerged as game-changers, revolutionizing the way people transfer money and conduct transactions.

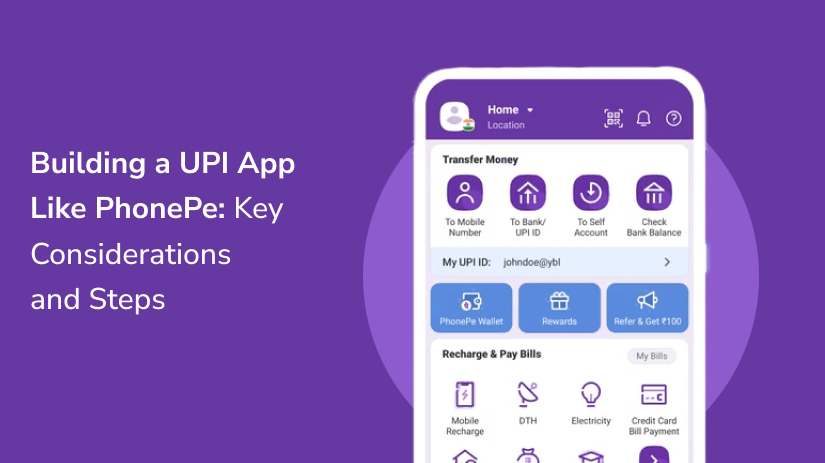

Among the notable players in this space, PhonePe has garnered significant attention, boasting user-friendly features and robust functionalities.

If you’re considering building a UPI app akin to PhonePe, you’re embarking on an exciting journey that demands careful planning and execution.

In this guide, we’ll delve into the key considerations and steps involved in developing a UPI app that rivals PhonePe’s success.

Let’s Start!!

Understanding the UPI Ecosystem

Before diving into development, it’s crucial to grasp the intricacies of the UPI ecosystem. UPI enables instant fund transfers between bank accounts through mobile devices with a single identifier, simplifying transactions for users.

Familiarize yourself with UPI guidelines and regulations to ensure compliance throughout the development process.

Connect with us for Fintech Development Needs

Trusted by companies like Plaid, Yodlee, Codat.

Market Research and Analysis

Conduct thorough market research to identify your target audience, their preferences, and existing market gaps.

Analyze competitors like PhonePe to discern their strengths, weaknesses, and unique selling propositions. This insight will inform your app’s feature set and help you differentiate it in a crowded marketplace.

Feature Set Definition

Define a comprehensive feature set based on your research findings and target audience preferences. Emulate successful features of apps like PhonePe while incorporating innovative functionalities to enhance user experience.

Key features may include seamless fund transfers, bill payments, UPI QR code scanning, rewards programs, and intuitive user interfaces.

Technology Stack Selection

Choose the right technology stack to power your UPI app. Consider factors such as scalability, security, and performance.

If you lack in-house expertise, partnering with a reputable financial software development agency specializing in money transfer software development can streamline the process.

Leverage technologies like Ruby on Rails for efficient development, or consider offshore Ruby on Rails development for cost-effective solutions.

Security and Compliance

Security is paramount in financial applications. Implement robust security measures to safeguard user data and transactions.

Adhere to industry standards and regulatory requirements, such as PCI DSS compliance and data encryption protocols. Conduct regular security audits and penetration testing to identify and address vulnerabilities proactively.

Connect with us for Fintech Development Needs

Trusted by companies like Plaid, Yodlee, Codat.

User Experience (UX) Design

Invest in intuitive UX design to enhance user engagement and retention. Prioritize simplicity, clarity, and accessibility in your app’s interface.

Conduct usability testing to gather feedback and iterate on design improvements iteratively. Seamless navigation and personalized experiences can significantly impact user satisfaction and app adoption.

Testing and Quality Assurance

Rigorous testing is essential to ensure your UPI app functions flawlessly across various devices and platforms.

Conduct comprehensive testing, including functional testing, performance testing, and security testing. Address any bugs or glitches promptly to deliver a seamless user experience.

Launch and Marketing Strategy

Plan a strategic launch for your UPI app, accompanied by a robust marketing strategy. Utilize digital marketing channels, social media platforms, and influencer partnerships to generate buzz and acquire users.

Leverage fundraising software to secure necessary capital for marketing efforts and ongoing app enhancements.

Continuous Improvement and Innovation

The journey doesn’t end at launch; it’s essential to continuously monitor user feedback and market trends to iterate on your app and introduce new features.

Foster a culture of innovation within your development team and stay agile to adapt to evolving user needs and technological advancements.

Conclusion

In conclusion, building a UPI app like PhonePe requires careful planning, technological expertise, and a deep understanding of user preferences and market dynamics.

By following these key considerations and steps, coupled with collaboration with a reputable financial software development agency and leveraging technologies like Ruby on Rails, you can create a compelling UPI app that resonates with users and drives financial inclusion and convenience.

Whether you choose to undertake development in-house or opt for offshore Ruby on Rails development, prioritize security, usability, and innovation to position your UPI app for success in a competitive landscape.

Happy UPI App Development!!

Connect with us for Fintech Development Needs

Trusted by companies like Plaid, Yodlee, Codat.